Quantum AI Phone Calls

Main

Quantum AI Phone Calls

Quantum AI Phone Calls. With a well-designed investment strategy, you can achieve financial stability and build wealth through smart real estate investing. Since it is the era of fast-paced technology-oriented functioning, AI helps as it facilitates trading every millisecond. Normalising from excess liquidity is proving painful for Australia, but like Omicron it is not fatal. Structured products

We base our investment decisions on whether or not the share price is trading at a discount to our assessment of intrinsic value and we have no regard as to where the share price has been in the past. Our woodworking courses cover a number of trades including carpentry, furniture making, joinery, and shopfitting. We also provide retail clients with access to the dynamic and growing warrants market in Asia. Overcoming these challenges and risks will help to build competitive advantage in the development of Australia’s quantum technology industry. They can track a wide variety of sector specific, country specific or broad market indices and can therefore be used to provide an inexpensive way of diversifying a Portfolio. exchange. If you can’t figure out roughly how long you think you might invest your money for, then you probably shouldn’t invest. Another major step forward for AI in trade finance will be the further standardization of trade documents and data formats.

Quantum AI The Mirror

Depending on the asset class you are trading, drawdown risk is curbed by assessing the diversification of a portfolio as well as the effort required to overcome it. If you have more than one type of trading, casual or miscellaneous income you can still only claim one trading allowance but you can choose how to allocate the allowance between your income sources. That is 170,000 people lower than our November forecast for the peak rate of 4.9 per cent (left panel of Chart 2.15). As we enter a new era of trade, we are here to simplify the challenges you face wherever you operate at every step of your journey because this is what we specialize in so you can specialize on your anything. As a short-term trader, you want to ride the waves and take advantage of bull runs. At XTB, we offer 30 international indices, including DE30, US30, US500, US100, UK100 and JAP225, so you can trade any of the world's biggest and most popular indices with us. It does this by considering seven or more variables, including recent trade clustering, which can help determine whether it’s a buyer’s or seller’s market. In the distribution of investors, many academics believe that the richest are simply outliers in such a distribution (i.e. in a game of chance, they have flipped heads twenty times in a row).

Is Quantum AI Legit

"When the market is going up and up, it's easy for investors to think they're more comfortable with risk than they actually are," says Mark Riepe, head of the Schwab Center for Financial Research. Margin credit is extended by National Financial Services, Member NYSE, SIPC. After spending weeks chatting with ChatGPT, I think I’ve finally managed to optimize the process to using the AI chatbot to help analyze stocks. Last year, Google's artificial intelligence lab partnered with U.S. space agency NASA on quantum computing research. It depends on a number of factors, such as how much risk capital you have in the first place, and whether you take positions over the short, medium or long-term.

Quantum AI Is It Real

keep a close eye on them. In chapter 6, the huge potential of e-commerce was surveyed – as both consumers and business increasingly buy and sell using online services and platforms, this could transform the way in which international commerce is conducted. Quantum AI Phone Calls

Financial dreams

Quantum AI Phone Calls. For most sectors listed in the schedule there are no limitations on foreign participation, consumption abroad, cross-border supply or commercial presence. There are several things that you should take into consideration before investing. The year 2020 started with what at first appeared to be a localized health crisis caused by a viral disease. However, getting price pressures to trend down from lofty levels is not the same as building confidence that it will get all the way back to 2%. To trade setups like this profitably requires a large number of trades. Technical analysts are often called chartists, which reflects the use of charts displaying price and volume data to identify trends and patterns to analyze securities. Quantum AI Phone Calls. So for technical and economic reasons, development was held off until 20 years later. We use that information to determine what should be reflected in our forecast. For that reason, investors want to know that your business isn’t just your job — it’s something you feel you were born to do.

Previous Next

Other:

Quantum AI Fintech

Quantum AI And Martin Lewis

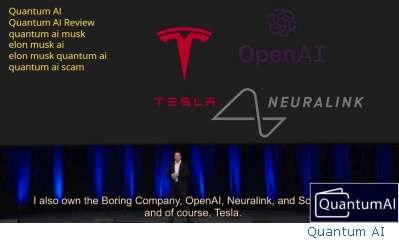

Quantum AI Elon Musk Reddit

How Legit Is Quantum AI